[Malaysia Financial Insight | Kuala Lumpur, May 2025]

As we step into the first half of 2025, Malaysia’s Employees Provident Fund (KWSP) has announced a major overhaul to the existing EPF Withdrawal system through the newly implemented EPF 2025 policy. This transformation not only streamlines the KWSP withdrawal process, but also redefines how Malaysians approach retirement planning.

In the face of economic shifts and rising inflation, Malaysians are now faced with a sobering question:

“If I withdraw today, will I still have enough to survive tomorrow?”

EPF 2025 Policy: Enhanced Three-Account System Offers Freedom—But With Risks

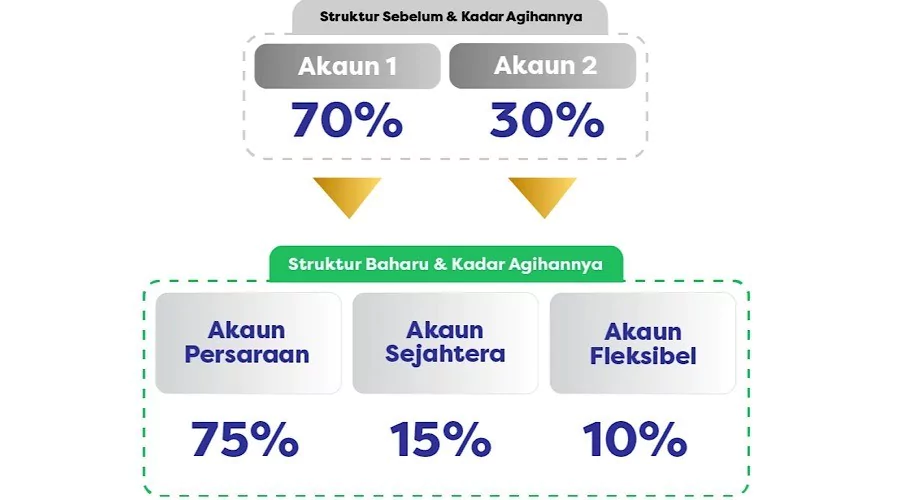

According to KWSP’s official announcement, the new EPF 2025 policy introduces significant changes:

- Account 3 officially launched: Up to 10% of employees’ 11% monthly contributions are now allocated to Account 3, which allows for flexible withdrawals anytime.

- Pre-withdrawal warning system: Before any transaction, users receive a projection chart showing potential retirement impact.

- Expanded emergency withdrawal categories: New uses now include student loan repayments, medical insurance payments, and family emergencies.

- Simplified KWSP withdrawal process: A brand-new system enables approvals in as fast as 24 hours.

While these changes appear empowering, financial experts caution that increased freedom might lead to impulsive withdrawals—creating greater risks for the future.

KWSP Withdrawal Process in 2025: 6 Key Steps You Must Know

The upgraded KWSP withdrawal process is now faster, more transparent, and smarter:

- Log in to the MyEPF app or official KWSP website.

- Select “Withdrawal Services” and choose the relevant account and category.

- The system evaluates age, balance, and withdrawal history.

- Upload required documents, such as ID and proof of emergency.

- An AI-generated “Future Retirement Projection” is displayed for review.

- Submit the request—funds can be disbursed within 24 hours.

Importantly, the system updates your projected retirement balance after each transaction, helping users make informed and responsible choices.

Financial Experts Warn: Just Because It’s Easy Doesn’t Mean You Should

According to Dato’ Lim Ji Hao, President of the Malaysian Association of Financial Planners, the simplified process does not mean withdrawals are risk-free.

He said, “Many young workers see Account 3 as a quick solution to financial stress. But they forget—every withdrawal chips away at your future comfort.”

His three key recommendations for smart retirement planning:

- Set a minimum retirement target: RM240,000 as a base ensures RM1,000/month for 20 years post-retirement.

- Limit withdrawal frequency: No more than twice a year to preserve long-term funds.

- Treat Account 3 as a last resort: Create a separate emergency fund outside EPF for daily or unexpected expenses.

This Isn’t Just a EPF Withdrawal Reform—it’s a Cultural Shift in Personal Finance

On a broader level, the EPF 2025 policy is more than just a mechanical update; it represents a fundamental shift in how Malaysians perceive financial responsibility.

By giving users more power, the government is simultaneously pushing them to take charge of their future. In other words:

“You’re free to withdraw, but you’re also responsible for the consequences.”

True wisdom lies not in the freedom to withdraw—but in knowing when and why you should.

Public Reaction Split: Is Flexible Withdrawal Misleading the Younger Generation?

In a recent public survey, young employees largely welcomed the move. “Now I can decide what to do with my money,” said Amir, a 24-year-old engineer.

However, older citizens expressed concern. “Youngsters haven’t experienced retirement hardship yet. What will they do when their savings run out?” asked 58-year-old Madam Cheong.

KWSP data shows that over 62% of retirees in Malaysia have less than RM50,000 in savings by age 60—a worrying figure that highlights the danger of over-withdrawing.

Final Thoughts: EPF Withdrawal Policies May Change—But Planning Is Still King

This newly liberalized EPF withdrawal system represents a turning point. It hands the power of decision-making back to individuals. But along with that power comes responsibility.

Choosing to withdraw today defines the lifestyle you’ll live tomorrow.

Be wise. Be strategic. And above all—plan ahead.